We specialize in Medicare enrollments as well as finding a plan that will assist in medical costs. By using Insurance With Don you can get connected with a Medicare agent in Altadena and find plans available to you while avoiding common Medicare mistakes. We can help you navigate the complexities of Medicare, recommend the best options for your specific needs, and answer questions about all of the changes happening with Medicare every year. Call the number down below to speak to a licensed agent now! (833) 658-6481

Original Medicare

Original Medicare is a federal health insurance program offered to California individuals 65 years or older, certain qualifying health conditions, and those receiving Social Security Disability Income for over 24 months. Medicare is broken up into Parts A and Parts B that cover you for your hospital and medical expenses. Medicare has a broad network that you can utilize for doctors and hospitals, but has high out of pocket exposure on its own. This is why we recommend pairing Medicare with either a Supplement Plan or Advantage Plan. You will also need a Part D Prescription Drug Plan if you opt for Original Medicare only, a Supplement Plan, or a Medicare Advantage without Part D included.

Part A Hospital Insurance

Part A has no monthly premium if you have worked at least 10 years or 40 quarters, or a spouse has. Part A covers you for inpatient services, skilled nursing facilities, home healthcare and hospice. Part A has a deductible that covers you for the first 60 days that you are hospitalized.

Part B Medical Insurance

Part B has a monthly premium of $185 in 2025 for most people, a yearly deductible of $257, and a 20% coinsurance for any medical services. Part B must be paid unless you qualify for Medicaid or other programs that assist with the cost of Original Medicare. Part B will cover your doctors, outpatient care, some home health services, some durable medical equipment and prescriptions, and some preventative services.

Medicare Supplement Plans Altadena, CA

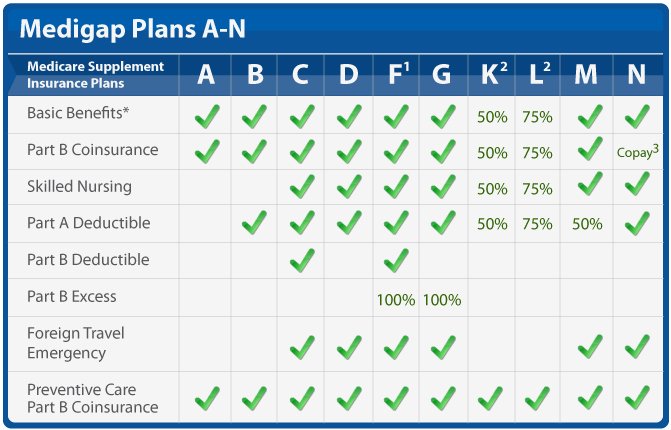

Medicare Supplement Plans offered by private insurance companies can fill in the gaps of Original Medicare (Parts A&B), protecting you from large hospital bills. Medigap plans are standardized, meaning that no matter what carrier you choose they will offer the same basic benefits. Plans are categorized by letters A-N, with different levels of coverage between each letter. With a Medicare Supplement plan you can go to any doctor that accepts Medicare, with no referrals or preauthorization needed.

Medicare Supplement plans fill in the gaps of Original Medicare such as the Part A deductible and 20% co-insurance for Part B. Medicare Supplements have a monthly premium that you pay based on your age, plan of choice, and the carrier. Medicare Supplements are standardized, meaning no matter what carrier you choose, all plans will be the same and only the prices will vary.

Medicare Supplement Plans do not have networks like Medicare Advantage Plans. If a doctor or hospital accepts Original Medicare they are required to accept your Medicare Supplement Plan. This allows you to utilize the care of your choice without being confined to networks and doctors not accepting Advantage plans. Medicare Supplements don’t require prior authorizations or referrals either, meaning you and your physician are in control of your health care, not your insurance company.

Choosing a Medicare Supplement Plan

It’s important to make an educated decision when choosing a Supplement plan because you may only get one opportunity to do so. Medicare Supplements require medical underwriting if you enroll outside of your eligibility period (IEP). For those who can not medically qualify you may be denied by the insurance carrier and not able to enroll or switch plans. You will also have to go through medical underwriting if you wish to switch to a carrier with better rates and stability, outside of your IEP, unless you are losing coverage from your current plan.

We’re able to look at the Medigap plans available as well as compare rates and rate stability to ensure we enroll you in a plan that will be the right fit for you long term. Make sure to speak with us before enrolling!

Medicare Supplement Costs

Medigaps have a monthly premium cost that ranges from $146 and $225 per month for the most popular plans like F, G, and N on average in the Los Angeles region. Medigap premiums are in addition to your Part B premium, which might turn some Medicare beneficiaries away. Although Medicare Supplements often have a higher premium then an Advantage Plan, you have no copayments and coinsurance if you choose Plan G, only your yearly Part B deductible ($257 in 2025).

Medicare Supplements are not pay-as-you-go like a Medicare Advantage plan, meaning you pay a consistent monthly price for your coverage, which may be a better option for certain individuals. This is especially true for those who use their health insurance frequently (cancer patients) and risk high out of pocket costs for treatment.

Medicare Supplement Plan Types

Medicare Supplements are categorized by letters A-N, with different levels of coverage, or gaps that they fill for each one. The most common plan choices for our clients are Medigap Plan G and Plan N because they fill most of the gaps of Original Medicare. Choosing these plans allows you to protect yourself from the high out of pocket expenses of having only Original Medicare.

Medicare Supplement Plan G

Plan G, as you can see from the chart, covers the most gaps of Original Medicare next to Plan F which is no longer available (Jan, 1 2020). We recommend Plan G to all of our clients that are interested in Medicare Supplements because offers the most coverage and peace of mind for your health insurance.

Medicare Supplement Plan N

Plan N is our next best behind Plan G due to the small copays for doctor visits and non-admitted emergency room visits that Plan N has. Plan N is still great coverage, but often times the savings are minimal with Plan N, so Plan G still makes more sense for most of our clients!

Benefits of Choosing a Medicare Supplement Plan

Although a Medigap will come at a higher monthly premium when compared to an Advantage Plan, there are a handful of benefits when choosing a Supplement Plan. You’ll have more control over your health insurance and treatment options when using a Medicare Supplement Plan, but the costs will be more up front then they would with a Medicare Advantage Plan.

Networks

Medicare Supplements fill in the gaps of Original Medicare, but do not take over for Medicare as an Advantage Plan would, meaning there are no networks for these plans. As long as a hospital or doctor in Altadena accepts Original Medicare they must accept your Supplement. You will also not need to receive a referral in order to see specialists when using one of these plans. You’ll also be able to use this coverage nationwide!

Prior Authorizations

Unlike Medicare Advantage plans, that are managed care, Medicare Supplement Plans do not require prior authorizations from the insurance company. This can save you time and hassle when certain procedures are needed for your treatment. As long as it is deemed medically necessary by your physician the insurance company will cover it.

Copayments and Coinsurance

Copayments and Coinsurance are utilized primarily with Medicare Advantage Plans, which allows them to offer lower monthly premiums, but will drive up the cost the more you use them. Medicare Supplement plans offset high copayments and coinsurance with a higher monthly premium. Depending on the plan of choice (Supplement Plans A-N) you may only be responsible for your Part B deductible, or very minimal copays and coinsurance.

What You Need to Know Before Enrolling

There are some very important rules that need to be disclosed to you before choosing a Medicare Supplement plan, as well as an Advantage Plan, to make sure you don’t get stuck with a poor plan decision or penalties.

Medicare Supplement Open Enrollment Period (OEP)

When you turn 65 and are enrolled into Part B you have a 6 month window to enroll in a Medicare Supplement plan with no medical underwriting (guaranteed issue). Outside of this window you will have to answer qualifying health questions and can even be denied a Medicare Supplement plan. It’s recommended to enroll in a Medigap during this 6 month period, especially if you have health issues, so you have a guaranteed option for enrolling.

Medical underwriting is also required if you ever decide to change carriers of a Supplement Plan or if you decide you want to change to a different plan letter (A-N). Plans are standardized, meaning the coverage will be the same no matter the carrier, but the pricing and rate increases can be different. This is why we recommend using a broker that has access to the best rates, and knows the stability of the plans in your area, that way you can enroll in the correct plan the first time!

Birthday Rule

California utilizes the Birthday Rule, which allows those already enrolled in a Medigap plan to switch to a different plan with the same or lesser benefits during a 60-day period following their birthday, without needing medical underwriting, according to the California Department of Insurance. You can use this enrollment period to switch Medicare Supplement plans with no medical underwriting!

Trial Period (Trial Rights)

If you move from a Medicare Supplement Plan to a Medicare Advantage Plan you have a 1 year time period that you can switch back to the Medicare Supplement Plan you were enrolled into prior with no medical underwriting.

Prescription Drug Coverage (Part D)

Medicare Supplement Plans do NOT offer any Part D Prescription Drug Coverage or any Dental, Vision, and Hearing. You will need to enroll into a Part D plan separate from your Supplement to avoid penalties for Part D. If you are turning 65 you can use the same 7 month period (Initial Enrollment Period) to enroll in a Prescription Drug Plan. If you’re retiring you will only have a 63 day period (Special Enrollment Period) to get enrolled in a Prescription Drug Plan to avoid Part D late penalties.

Medicare Advantage Plans Altadena, CA

Medicare Advantage Plans are offered by private insurance companies in Altadena, that take over for Original Medicare (Parts A&B). With Medicare Advantage Plans your prescription drug coverage is often included, as well as extra perks such as gym memberships, groceries, and over the counter allowances (not all plans). Some plans even include dental and vision.

When you are eligible and enrolled into Parts A&B for Original Medicare you have the option to utilize a Medicare Advantage Plan. You will still be responsible for your Part B premiums, but your Advantage plan will take over for Original Medicare, giving you added benefits and coverage.

Instead of being exposed to the Part A deductible and 20% co-insurance from Original Medicare you will have copays, coinsurance and a maximum out of pocket that is set by your Medicare Advantage Plan. This gives you a ceiling for your medical bills and protects you from high yearly costs. If you choose an advantage plan that includes your Part D prescription drug coverage you will also have a deductible and maximum out of pocket for your prescription costs. Every plan will have different costs associated with these so its best to have a local agent assist you in this process.

Choosing a Medicare Advantage Plan

There’s multiple factors that go into choosing the right plan for your needs and budget. Medicare Advantage plans are region specific, so we need to make sure we find the plans specific to Los Angeles. The next step is ensuring that your doctors and hospitals are In-Network and accepting the Medicare Advantage Plan of your choice. From there we will discuss various coverage options that best fit your specific health needs, such as choosing a plan with better dental or vision benefits, or a plan that has lower copays for specialists. We can shop the plan that will work best for you instead of squeezing you into a “one-size-fits-all” plan. We’ll also verify your medications on the plan’s formulary to know what your medications will cost you throughout the year and ensure the plan will cover them. Don’t miss this steps and have complications, use us as your local agent and we’ll take the headache out of Medicare!

Medicare Advantage Plan Costs

Advantage Plans will typically have a low monthly premium to be enrolled ranging from $0 – $15 in Altadena. This is what makes Advantage plans a good fit for a majority of beneficiaries. Advantage plans work as a “pay-as-you-go” system, meaning you will have copayments and coinsurance to utilize your coverage.

Copayments are a set cost that you will pay to see your doctors and specialists, and for some medical services such as X-Rays and MRIs. Most plans have a $0 – $50 fee to see your Primary Care Provider and a $50 – $100 fee to see a specialist, but every plan will have its own specific rates for services.

Coinsurance is a percentage of your hospital or doctor bills that you will be responsible for until you hit your yearly maximum out of pocket (MOOP). The percentage you will be responsible for usually ranges between 20% – 35%, but some plans can go as high as 50%. HMOs usually have lower coinsurance rates compared to PPO plans, but narrower networks that you will have to work with.

Most plans will have a yearly maximum out of pocket that cannot exceed $9,350 (with most plans in Altadena being lower) meaning the insurance company picks up the rest of your medical bills after you’ve met this limit. You don’t have to meet your maximum for insurance to cover your primary doctor or specialist visits, as these will have a copay, and that is all you need to pay in order to receive those services. Your MOOP for medical expenses doesn’t count towards your yearly cap for prescription drugs (Part D Prescription Drug Plans).

Prescription Drug Plans Altadena, CA

If you’re enrolled into Original Medicare, utilizing a Medicare Supplement Plan, or an Advantage Plan with no Part D include, you will need a Medicare Part D Prescription Drug Plan for your prescription drug coverage. This can be a stand alone plan, or included in your Medicare Advantage (Part C) plan.

Part D Prescription Drug Plans are either stand alone or embedded in a Medicare Advantage plan. They have their own monthly premiums, yearly deductibles, and copayments/coinsurance that will be separate from Original Medicare, your Supplement Plan or your Advantage Plan. Prescription Drug Plans use a formulary, which is a list of drugs the insurance company covers, which we can use to determine your yearly costs for prescriptions and any out of pocket costs you might incur.

Formulary

We enter your current prescriptions into the plans formulary in order to find the cost of your Part D coverage throughout the year. By doing so we’ll know if you have to meet your deductible and any copayments or coinsurance you will need to pay. Not all prescriptions cost the same, and most of your generics will have no charge or a low copayment, while more name brand drugs will have higher copays.

It is important to search the formulary of a plan before enrolling to make sure your prescriptions are covered! Reach out to us and we can assist you with this process.

Drug Tiers

Prescription Drug Plans categorize prescriptions in 5 different tiers:

- Tier 1 (Preferred Generics)

- Tier 2 (Generics)

- Tier 3 (Preferred Brand Names)

- Tier 4 (Non-Preferred Drugs)

- Tier 5 (Specialty Drugs)

Tier 1 and tier 2 prescriptions will have the lowest copay amounts, while tier 3 drugs and higher will have more expensive copays and coinsurance, and will also require you to meet your deductible.

Monthly Premiums

Most Part D plans will have a monthly premium ranging from $0 – $20 per month depending on your zip code and the carrier. Although your plan might have a low premium it could have a high yearly deductible or higher copays/coinsurance, so its important to compare the options in your area.

Yearly Deductible

Prescription Drug Plans have a yearly deductible of $590 in 2025. Not every plan will have a deductible this high, but this is the maximum it can be for the year of 2025, with expected increases for future years. Tier 1 and 2 typically don’t require you to meet your deductible in order to be covered. Tier 3 and higher will most often cause you to meet your deductible as well as have copayments or coinsurance.

Copayments and Coinsurance

Drug plans will have their own copayments and coinsurance for certain prescription drugs depending on the cost and tier that they are on. Tier 1 & 2 prescriptions will have lower to no copays, but tiers 3 and up will, and you may need to meet your deductible as well.

Yearly Cap

As of 2025 Part D has a yearly cap of $2000 for your out of pocket expenses. This means you won’t pay more then $2000 for the year between your deductibles and any copays/coinsurance on your prescription drugs. Once you reach your cap you will not have to pay out of pocket for your prescriptions for the rest of the calendar year.

Enrollment Periods & Deadlines

Part D uses enrollment periods and deadlines for beneficiaries that are new to Medicare or those who are currently enrolled. These time periods allow you to enroll into Part D plans or to move to another Prescription Drug Plan.

Initial Enrollment Period (IEP)

If you’re turning 65 you will have a 7 month window to enroll in a Part D Prescription Drug Plan with no penalties, unless you are still working and have creditable coverage. This window ranges 3 months before your 65th birthday, the month of your birthday, and ends 3 months after you turn 65. During this period you can enroll into Original Medicare (Parts A & B) as well as a Supplement or Advantage Plan that may have Part D included.

Annual Enrollment Period (AEP)

The Annual Enrollment Period starts October 15th and ends December 7th of each year. During this period you can change Prescription Drug Plans as well as change your Advantage Plan that may have a drug plan embedded into it. You are able to make as many changes to your coverage as needed with changes taking effect January 1st of the following year.

Open Enrollment (for those in Medicare Advantage)

If you’re enrolled in a Medicare Advantage plan you have another period to make changes to your coverage. From January 1st to March 31st you can make a final change to your Medicare Advantage plan. Changes will be active the 1st day of the following month.

Special Enrollment Periods (SEPs)

Special Enrollment Periods are available to certain individuals based on life circumstances such as retirement, loss of coverage, and moving out of your current zip code. For those retiring you will have a 63 day window to be enrolled in a Prescription Drug Plan or a Medicare Advantage Plan with an embedded Part D plan to avoid late penalties. If you are losing coverage or moving you will have the same time frame to get enrolled into one of these plans as well.

Late Enrollment Penalty

If you enroll into Part D outside of your IEP/SEP or did not have creditable coverage while delaying Part D you may incur a Part D late enrollment penalty. This penalty is a monthly fee that is added to your Part D premium, which is 1% of the “national base beneficiary premium” for every month delayed. This penalties will follow you for life, unless you qualify for Extra Help or Medicaid, so make sure you don’t delay your enrollments!

If you’re keeping employer coverage past the age of 65 its important to make sure that your coverage is deemed creditable and your employer has at least 20 employees on the payroll. If not you will be subject to these penalties! Speak to an agent to get the best advice and guidance for your Medicare decisions.

How to Choose the Right Drug Plan in Altadena

The first step to choosing the right Prescription Drug Plan for you is to check your current medications on a plans formulary. This can be easily done for both Medicare Advantage and stand alone drug plans on the Medicare.gov website. You will also be able to select your preferred pharmacy to know if they are in network with the plan of your choice.

This will allow you to get an idea of plan premiums and out of pocket costs prior to enrolling in a plan. We do this step for all of our clients to ensure they have the best coverage as well as the lowest out of pocket costs for them! The formulary will also let you see what tier your drugs are on, if you’ll meet your deductible, and what the expected copays/coinsurance will be for those drugs.

It’s important to look at both the monthly cost of a plan’s premium as well as the cost of your prescriptions. By using Medicare.gov we can compare the overall cost of your prescriptions between Medicare Advantage and stand alone drug plans and choose based on your budget and needs. You may even qualify for certain programs that can help reduce the costs of your medications!

How to Enroll In a Drug Plan

We can assist you in the enrollment process for a stand alone drug plans or a Medicare Advantage plan that will include your Part D coverage. We offer both in-person and virtual options for our clients! We make the process simple and hassle free, with most enrollments being completed in 15 minutes. Give us a call today to get started!

Call Now for Assistance  (833) 658-6481

(833) 658-6481

Other Medicare Resources for Seniors In Altadena, CA

Medicare can be a complex task for most seniors. There’s many resources and departments in Altadena designed to assist seniors with their healthcare needs. We’ve linked the most popular resources that seniors utilize when going on to Medicare.

California Department of Public Health

This department in California offers vital support for seniors by promoting wellness, disease prevention, and access to healthcare resources. For those on Medicare, CDPH provides important information about public health programs, vaccination schedules, long-term care facility oversight, and emergency preparedness. Seniors can use this resource to stay informed about health trends and state services that impact their well-being, especially in managing chronic conditions or navigating the healthcare system.

Social Security Administration Altadena

If you’re enrolling into Medicare or Social Security, the Social Security Administration is a critical resource for seniors as it manages the enrollment process for Medicare and provides essential benefits such as retirement income and disability support. Seniors can use the SSA website or offices to apply for Medicare, check their eligibility, and manage their benefits. It also offers guidance on avoiding fraud and protecting personal information. Access to SSA services helps seniors make informed decisions about their healthcare and financial stability in retirement.

California Health and Human Services Agency (CalHHS)

The California Health and Human Services Agency connects seniors with a wide array of state-run health and social services, including Medi-Cal, In-Home Supportive Services (IHSS), and mental health resources. For Medicare recipients, CalHHS plays an important role in coordinating care and providing additional support programs that may work alongside Medicare. Seniors can find help with accessing affordable healthcare, food assistance, housing support, and caregiver services through this agency, enhancing their overall quality of life.