Medicare Supplement Plans are insurance plans offered by private insurance companies that fill in the gaps of Medicare Part A and Part B. Medicare Supplement plans will not include your Part D prescription drug coverage or any of your dental, vision and hearing coverage.

How Medicare Supplement Plans Work

When you are eligible and enrolled into Parts A&B for Original Medicare you have the option to utilize a Medicare Supplement Plan (Medigap). You will still be responsible for your Part B premiums, and will also need Part D prescription drug coverage in addition to your supplement plan.

Medicare Supplement plans fill in the gaps of Original Medicare such as the Part A deductible and 20% co-insurance for Part B. Medicare Supplements have a monthly premium that you pay based on your age, plan of choice, and the carrier. Medicare Supplements are standardized, meaning no matter what carrier you choose, all plans will be the same and only the prices will vary.

Medicare Supplement Plans do not have networks like Medicare Advantage Plans. If a doctor or hospital accepts Original Medicare they are required to accept your Medicare Supplement Plan. This allows you to utilize the care of your choice without being confined to networks and doctors not accepting Advantage plans. Medicare Supplements don’t require prior authorizations or referrals either, meaning you and your physician are in control of your health care, not your insurance company.

Choosing a Medicare Supplement Plan

It’s important to make an educated decision when choosing a Supplement plan because you may only get one opportunity to do so. Medicare Supplements require medical underwriting if you enroll outside of your eligibility period (IEP). For those who can not medically qualify you may be denied by the insurance carrier and not able to enroll or switch plans. You will also have to go through medical underwriting if you wish to switch to a carrier with better rates and stability, outside of your IEP, unless you are losing coverage from your current plan.

We’re able to look at the Medigap plans available as well as compare rates and rate stability to ensure we enroll you in a plan that will be the right fit for you long term. Make sure to speak with us before enrolling!

Medicare Supplement Plan Costs

Medigaps have a monthly premium cost that ranges from $115 – $150 on average in the South Texas region. Medigap premiums are in addition to your Part B premium, which might turn some Medicare beneficiaries away. Although Medicare Supplements often have a higher premium then an Advantage Plan, you have no copayments and coinsurance if you choose Plan G, only your yearly Part B deductible ($257 in 2025).

Medicare Supplements are not pay-as-you-go like a Medicare Advantage plan, meaning you pay a consistent monthly price for your coverage, which may be a better option for certain individuals. This is especially true for those who use their health insurance frequently (cancer patients) and risk high out of pocket costs for treatment.

Medicare Supplement Plan Types

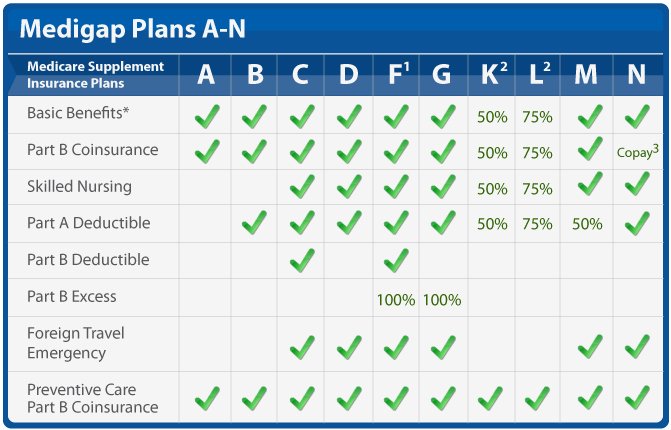

Medicare Supplements are categorized by letters A-N, with different levels of coverage, or gaps that they fill for each one. The most common plan choices for our clients are Medigap Plan G and Plan N because they fill most of the gaps of Original Medicare. Choosing these plans allows you to protect yourself from the high out of pocket expenses of having only Original Medicare.

Medicare Supplement Plan G

Plan G, as you can see from the chart, covers the most gaps of Original Medicare next to Plan F which is no longer available (Jan, 1 2020). We recommend Plan G to all of our clients that are interested in Medicare Supplements because offers the most coverage and peace of mind for your health insurance.

Medicare Supplement Plan N

Plan N is our next best behind Plan G due to the small copays for doctor visits and non-admitted emergency room visits that Plan N has. Plan N is still great coverage, but often times the savings are minimal with Plan N, so Plan G still makes more sense for most of our clients!

Benefits of Choosing a Medicare Supplement Plan

Although a Medigap will come at a higher monthly premium when compared to an Advantage Plan, there are a handful of benefits when choosing a Supplement Plan. You’ll have more control over your health insurance and treatment options when using a Medicare Supplement Plan, but the costs will be more up front then they would with a Medicare Advantage Plan.

Networks

Medicare Supplements fill in the gaps of Original Medicare, but do not take over for Medicare as an Advantage Plan would, meaning there are no networks for these plans. As long as a hospital or doctor accepts Original Medicare they must accept your Supplement. You will also not need to receive a referral in order to see specialists when using one of these plans.

Prior Authorizations

Unlike Medicare Advantage plans, that are managed care, Medicare Supplement Plans do not require prior authorizations from the insurance company. This can save you time and hassle when certain procedures are needed for your treatment. As long as it is deemed medically necessary by your physician the insurance company will cover it.

Copayments and Coinsurance

Copayments and Coinsurance are utilized primarily with Medicare Advantage Plans, which allows them to offer lower monthly premiums, but will drive up the cost the more you use them. Medicare Supplement plans offset high copayments and coinsurance with a higher monthly premium. Depending on the plan of choice (Supplement Plans A-N) you may only be responsible for your Part B deductible, or very minimal copays and coinsurance.

What You Need to Know Before Enrolling

There are some very important rules that need to be disclosed to you before choosing a Medicare Supplement plan, as well as an Advantage Plan, to make sure you don’t get stuck with a poor plan decision or penalties.

Medicare Supplement Open Enrollment Period (OEP)

When you turn 65 and are enrolled into Part B you have a 6 month window to enroll in a Medicare Supplement plan with no medical underwriting (guaranteed issue). Outside of this window you will have to answer qualifying health questions and can even be denied a Medicare Supplement plan. It’s recommended to enroll in a Medigap during this 6 month period, especially if you have health issues, so you have a guaranteed option for enrolling.

Medical underwriting is also required if you ever decide to change carriers of a Supplement Plan or if you decide you want to change to a different plan letter (A-N). Plans are standardized, meaning the coverage will be the same no matter the carrier, but the pricing and rate increases can be different. This is why we recommend using a broker that has access to the best rates, and knows the stability of the plans in your area, that way you can enroll in the correct plan the first time!

Trial Period (Trial Rights)

If you move from a Medicare Supplement Plan to a Medicare Advantage Plan you have a 1 year time period that you can switch back to the Medicare Supplement Plan you were enrolled into prior with no medical underwriting.

Prescription Drug Coverage (Part D)

Medicare Supplement Plans do NOT offer any Part D Prescription Drug Coverage or any Dental, Vision, and Hearing. You will need to enroll into a Part D plan separate from your Supplement to avoid penalties for Part D. If you are turning 65 you can use the same 7 month period (Initial Enrollment Period) to enroll in a Prescription Drug Plan. If you’re retiring you will only have a 63 day period (Special Enrollment Period) to get enrolled in a Prescription Drug Plan to avoid Part D late penalties.

Medicare Supplement vs Medicare Advantage Plans

Medicare Supplements will come at a higher front end cost when compared to a Medicare Advantage Plan. The coverage you receive from a Medigap comes with the advantage of no networks, no prior authorizations, and no referrals needed. On top of that you can use a Medicare Supplement anywhere that Original Medicare is accepted, even outside of your zip code!

Medicare Supplements offer more freedom and control than a Medicare Advantage plan does, and for those who will need to use the plan frequently it may even be a more affordable option. Discuss your health needs with a qualified broker to make sure you make the choice that is right for you!

Medicare Supplements are also written for life, meaning you won’t have to worry about yearly plan and network changes that may happen with Medicare Advantage. It is also less common for doctors or hospitals to not accept Original Medicare so you will have more options available to you.

Another less thought of perk is that Prescription Drug Plans are separate from your Supplement Plan so you will have more control over your drug plan and cost. Medicare Advantage Plans often have an embedded drug plan, so you have less control, and would have to change the plan entirely if you wanted different prescription coverage.

Is Medicare Supplement Right For You?

If you want predictability and control over your health insurance and have the budget for monthly premiums and rate increases over time a Supplement Plan might be right for you. Its important to weigh out all of your options and make an informed decision that is based on YOUR needs. We recommend you use a broker, such as ourselves, to give you all of the information and guidance to choose the right plan the first time. You might only get one chance to qualify for a Supplement Plan!

How to Enroll in a Medicare Supplement Plan

We’ll review the available Supplement Plans in your area to find you the best cost and lowest projected rate increases year over year. It’s imperative to enroll in the right plan the first time to avoid being stuck in an expensive plan. We always look for longevity and well established carriers to ensure this!

We’ll also look for your Prescription Drug Coverage using the same method. We can even enter your current prescriptions to give you an estimated yearly cost prior to enrolling and provide you with the best option based on your health needs. If you need any additional coverage, such as dental, vision and hearing, we can also shop these for you!

When Should You Enroll in a Plan?

If you are 65 and enrolled into Part B you can use your Initial Enrollment Period (IEP) to enroll in a Medicare Supplement Plan. You will need to have Medicare Parts A&B in order to be eligible. Your initial enrollment period starts after you are 65 and enrolled into Part B. It’s important to get enrolled during this period if you qualify in order to avoid medical underwriting and late penalties.

Some individuals will qualify for a Special Enrollment Period (SEP) if they are retiring and losing qualifying coverage. For those retiring you will have a 6 month window from your Part B start date to get enrolled into a plan, but only 63 days to get enrolled in Part D coverage. It’s important to get both of these coverages to avoid medical underwriting and late penalties for Part D.

You can enroll and change your Supplement Plan outside of these 2 enrollment periods, but you will be subject to medical underwriting if you do so. If you cannot pass the 21 health questions or have prescriptions that do not pass you will not be accepted into a new Medicare Supplement plan.

What Happens After You Enroll

After choosing and enrolling into a plan with one of our Medicare agents the carrier will send out your insurance card. Once received you will need to call the number on the back to activate your insurance card. One of our agents can assist you with this if needed!

Coverage will begin the first day of the following month that you enrolled in. If you need a temporary card or confirmation number to utilize before your card comes in the mail on of our agents can assist you!

Why Use an Insurance Agent?

Insurance agent provide you with expert guidance on plans in your area, the best options for you based on your needs, and support with the complications and yearly changes to Medicare at absolutely no cost to you! Medicare can be a confusing topic, which is why we’re here to help you navigate the process. Give us a call today to get free assistance with your Medicare and enrollment needs!